Payday Loans, Cash Advance Loans: Floatme, Dave, Albert…

FloatMe is a San Antonio tech startup that makes cash advances to workers against their next paycheck. It just raised $16.2 million in its latest fundraising round.

FloatMe, with a headcount of 60 employees and an office on Soledad Street in downtown San Antonio, is a member of online and mobile cash-advance companies that offer fast access to cash at supposedly low APR’s. They compete with payday loan lenders who provide quick, no-hassle cash to subprime borrowers in need of emergency funds before their next payday arrives.

FloatMe’s membership financial service is similar to fintech firms such as https://dave.com/ , https://www.moneylion.com/ https://www.earnin.com/ , https://albert.com/

As one example, Dave.com has 11,000,000 subscribers paying $1/month simply to have ACCESS to $75 “loans.”

Like its larger rivals, FloatMe says it provides customers with cash advances on their wages, not loans. The CFPB & a multitude of State Attorney Generals tend to have a different interpretation. Regulation is coming hot & heavy!

Regarding FloatMe, customers pay a monthly fee of $1.99 and can request small advances — of no more than $50 — that they repay when their upcoming paychecks appear in their bank accounts.

The startup’s terms of service say users must be U.S. citizens, at least 18 years of age, & have a cell phone and an email address. To create an account, customers authorize the company to access their bank account balance and transaction histories. [This is outsourced to companies like Plaid.

FloatMe customers must prove they’ve received at least $200 in electronic wage deposits three times before they can request advances.

After approval, borrowers receive their cash advances through an ACH transfer to their bank accounts in one to three business days. Or they can pay $4 for an “instant” cash drop within eight hours. [Dave charges $4.99 AND requests a default tip of 15%! All in, APR could hit 600%+ depending on how long the “loan” is outstanding.]

Payday loan lenders can provide funding immediately and are 100% transparent. The fees charged by these new Fintech players are often hidden on separate web pages & popups. Dave, Albert, FloatMe… fees for faster access to cash advances have gotten the attention of regulators, consumer advocates, competitors… The majority of the borrower applicants need cash in their hands IMMEDIATELY! They are desperate to pay the addon fees in return for instant cash.

“These kinds of fees are interpreted to be voluntary but they really add up for consumers,” said Yasmin Farahi, a senior policy counsel at the Center for Responsible Lending, a North Carolina-based nonprofit research and policy group.

“FloatMe users also can receive pitches from third-parties companies for financial-management services or products — if they choose to, according to the startup.”

From the terms of service: “In all cases, you will need to ‘opt in’ to receive these partner offers, and FloatMe may receive compensation from these partners for connecting you with them. FloatMe is not responsible for the products and services offered by those partners.”

The Center for Responsible Lending has evaluated the average annual percentage rates, or APRs, for a $300 loan with repayment periods of 14 days in each state. The data shows Texans can pay up to 664 percent APR.

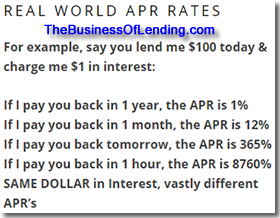

HOWEVER, HERE IS THE TRUTH ABOUT CALCULATING APR’s:

Much like FloatMe’s peers claim, they are NOT payday loan lenders!

“FloatMe is focused on transparency,” said the Founder. “We charge $1.99 per month for members to access out personal finance management tools, overdraft alerts, and other budget management features. Members can access floats without having to pay $1.99. There are no credit checks. There’s no interest and no hidden fees.”

However, consumer advocates are having nothing to do with this claim! As of today, these Fintech players are not regulated. I’m [Jer Ayles] certain this will soon change!

“A lot of them {Fintechs] try to say they’re not loans, but we believe they’re loans and should be regulated under consumer protection laws and state lending laws,” says the CRL. “Obviously in Texas, those laws aren’t strong when it comes to user caps, but we are concerned that they’re trying to get carve-outs from state and federal lending laws saying they’re not loans. And really, a lot of these are payday loans in another form.”